Georgia goal scholarship program

Register now for your 2026 GOAL tax credit!

Redirect the state income taxes you already pay to help Holy Redeemer.

what is goal?

The Georgia GOAL Scholarship Program is a powerful way for individuals and businesses to positively impact lives by making private education accessible to deserving students who otherwise could not afford it.

The Georgia Private School Tax Credit Program allows Georgia taxpayers to designate tax dollars to specific schools in the state, like Holy Redeemer. The schools, in turn, utilize these funds to provide need-based financial aid to students and families.

Why should I participate?

By contributing to GOAL, Georgia taxpayers receive a 100% state income tax credit, while directly supporting tuition assistance for exceptional students desiring to attend Holy Redeemer. Each year, the Georgia Private School Tax Credit Program, combined with support from our Annual Fund, plays a critical role in Holy Redeemer's overall financial aid program. Funds raised through GOAL are used to provide tuition assistance for qualifying students attending Holy Redeemer. Your participation empowers students to receive an excellent Catholic education, supports families in choosing the best educational environment for their children, and strengthens the well-being of our school community.

Who can participate and what are the tax credit limits?

All Georgia taxpayers, including individuals, partnerships, and corporations, are eligible to receive a 100% state income tax credit in exchange for their contributions to Georgia GOAL. You must apply for your 2026 tax credit by December 31, 2025.

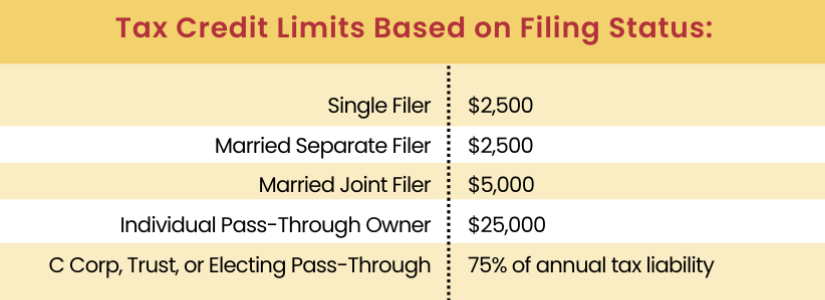

Tax credit limits based upon taxpayer filing status are as follows:

How do I sign up?

To secure your 2026 GOAL tax credit, you must submit your application before the end of 2025. Apply today by visiting www.goalscholarship.org. GOAL will handle all remaining steps in the process until your contribution is due in mid-March 2026, within 60 days following approval by the Georgia Department of Revenue.

THINGs to note

The overwhelming success of the GOAL program speaks volumes about its importance. Year after year, demand surpasses the allocated cap of $120 million within the first business day of the year, as it did again in 2025. This leads to proration of all applications. 2025 participants received only 53.3% of their requested amount due to oversubscription. Holy Redeemer uses every dollar contributed, so please consider requesting the full amount allowable when registration for 2026 opens in June 2025.

Georgia GOAL, through the Georgia Private School Tax Credit Program, provides an opportunity for participants to redirect tax liability already owed to the State of Georgia to a restricted priority (financial aid) at a favorite school. Therefore, participation in the program is not related to participation in Holy Redeemer's Annual Fund.